The transaction is expected to be completed during September 2020. After the sale of the property development operation, Veidekke will be a focused Scandinavian construction group with a strong market and financial position. After completion of the transaction, the Board of Veidekke will propose payment of an extraordinary dividend of NOK 20 per share.

“Since November, Veidekke has considered various alternatives for the demerger of the property development operation, in order to facilitate its long-term development under a new ownership structure and to focus on the group’s construction operation. After a thorough process, the Board has concluded that the best solution both industrially and financially is to divest the business, and this solution will moreover realise shareholder value,” says Svein Richard Brandtzæg, Chair of the Board of Veidekke.

“We are pleased that Veidekke has accepted our offer, and that we and our partners will own Veidekke’s property development operations in Sweden and Norway, which include many exciting projects,” says Tollef Svenkerud, Chairman of Fredensborg Bolig.

“Ongoing projects are well taken care of by a professional organisation, with Baard Schumann intended to head up the overall operations in Norway and Sweden, replacing Jørgen Wiese Porsmyr, who will remain with Veidekke ASA,” says Bent Oustad, CEO of Norwegian Property ASA.

The transaction will be completed as the Buyer acquires the shares in Veidekke Property Development in Norway and Sweden against a consideration in the amount of approx. NOK 3.3 billion. Simultaneously, Veidekke Property Development's debt to Veidekke ASA of approx. NOK 4.2 billion will be repaid, while NOK 200 million comprising deferred project payments will be paid upon project completion. Invested capital in the property development operation amounted to NOK 6.3 billion (IFRS) at the end of the first quarter. Based on the IFRS accounts, the transaction will generate a posted gain of approx. NOK 1.2 billion.

“The transaction will release significant funds, which will place Veidekke in a strong position for further development of the business. Veidekke will remain a profitable and solid company that continues to create and realise value for our customers, employees and shareholders. Residential construction will remain an integral part of our business, and as a leading Scandinavian residential construction company, we look forward to working with the new owner in the future,” says Jimmy Bengtsson, CEO of Veidekke.

At the close of first quarter 2020, Veidekke’s net interest-bearing debt amounted to NOK 2.6 billion. Part of the sales proceeds will be used to repay debt, in order to ensure desired adjustments in the financing structure to support the company’s future growth and development. Once the transaction is completed, the Board of Veidekke will convene an extraordinary general meeting in the second half of 2020. The Board will propose to the extraordinary general meeting payment of an extraordinary dividend of NOK 20 per share from the proceeds from the sale of the property development operation. Veidekke has an unequivocal ambition of distributing remaining liquidity from the transaction, as well as the cancelled dividend based on the 2019 financial statements, in the near future, as soon as the uncertainty e.g. related to the Covid-19 pandemic has been resolved.

ABG Sundal Collier and the law firm Schjødt served as, respectively, Veidekke's financial and legal advisers in the process. The consortium's advisers were Arctic Securities, DNB Markets, PWC, the law firm Thommessen in Norway, and the law firm Vinge in Sweden.

Analysts and investors are invited to attend a short video conference today at 16:00 CET. There, CEO Jimmy Bengtsson and other members of Veidekke's management team will briefly outline the transaction and answer questions. The video conference will be conducted in Norwegian, without translation.

To dial in:

Join the meeting: https://pexip.me/meet/7263771052

Phone: +47 67209300

PIN: 7263771052 #

One-click smartphone dial-ins: + 4767209300,7263771052 #

For more information, contact:

Jimmy Bengtsson, Group CEO, ph. +47 984 70 000, jimmy.bengtsson@veidekke.no

Jørgen Wiese Porsmyr, EVP, +47 907 59 058, jorgen-wiese.porsmyr@veidekke.no

Lars Erik Lund, EVP, ph. +47 413 31 369, lars.lund@veidekke.no

Bård Schumann, ph. +47 940 80 000, baard.schumann@gmail.com

Tollef Svenkerud, Chairman Fredenstad Bolig, +47 917 76 594, tollef@fredensborgbolig.no

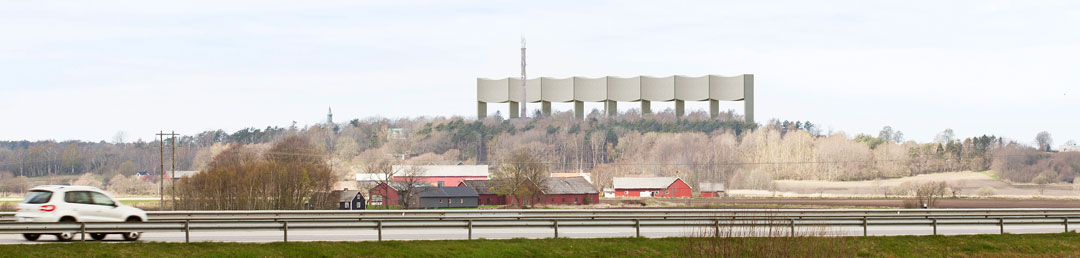

Veidekke press photos

Subscribe to notices from Veidekke

This information is subject to the disclosure requirements pursuant to section 5 -12 of the Norwegian Securities Trading Act.

Veidekke is one of Scandinavia's largest construction and property development companies. The company undertakes all types of building construction and civil engineering contracts, develops residential projects, maintains roads, and produces asphalt and aggregates. The company is known for its involvement and local knowledge. Its annual turnover is NOK 39 billion, and half of its 8,600 employees own shares in the company. Veidekke is listed on the Oslo Stock Exchange and has always posted a profit since it was founded in 1936.